VALUABLE CONVERSATIONS ON PLAN DESIGN

The design and compliance administration of retirement plans can be complex. To design a successful retirement plan, it’s important to consider certain features including Qualified Automatic Contribution Arrangements (QACAs), coverage requirements and after-tax contributions.

Definiti provides retirement consulting and service expertise to nearly 7,000 plans across the country. The bulk of these plans are found in privately or family owned small businesses, where one of the primary drivers is that the company’s leadership team wants to contribute the maximum amount to the plan.

Safe Harbor Overview

A safe harbor plan is a type of 401(k) with an employer contribution that allows a plan sponsor to avoid some of the most important discrimination tests applied each year.

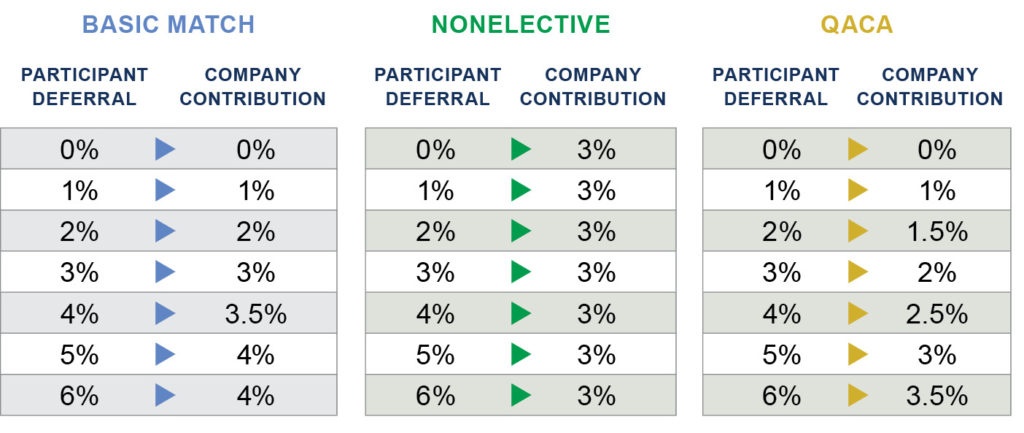

Most small plans in America use one of these safe harbor plan types:

- Basic match: The employer matches 100% of employee contributions, up to 3% of their compensation, plus a 50% match on the next 2% of their compensation. This can always be enhanced with a more generous formula.

- Nonelective: The employer contributes 3% of each employee’s compensation, regardless of whether employees contribute to the plan.

Say Hello to QACAs

Thanks to the Pension Protection Act of 2006, which facilitated the adoption of automatic-enrollment policies, we can add QACAs (a fun-to-say industry acronym) to the safe harbor mix.

QACAs and other auto-enroll plans were designed to increase worker participation in retirement plans. They feature automatic enrollment, where the match is 3.5% and a vesting schedule may apply to the match.

Automatic enrollment can make a plan more complicated because it shifts the burden to take action from the employee to the employer. But the benefits — higher participation, lower maximum matching contributions, a small federal tax credit to the company and a vesting schedule for the match — are appealing.

Benefits of Automatic Enrollment

Automatic enrollment plans enjoy about an 87% participation rate nationally, while those without it see much lower participation rates that average around the 60% range. This means almost a quarter of the eligible workforce is missing out on the benefits of retirement savings simply due to the fact they weren’t auto-enrolled in a plan.

87% AUTOMATIC ENROLLMENT PARTICIPATION60%NON AUTO ENROLLMENT PARTICIPATION

Source: Ted Godbout, Auto Features Push Plan Participation, Contribution Rates to Highest in a Decade, ASPPA, 2020

Not only does automatic enrollment help employees make retirement savings a priority, the automatic enrollment feature also defaults participant contributions all the way up to the company’s maximum matching amount.

QACA plans check many boxes for a plan sponsor. We believe more companies should utilize them and that employers should default new participants at 6% from day one.

Coverage Requirements and Eligible Employees

The concept of an eligible employee may seem cut and dry: Once someone meets the service criteria, there are no other requirements, and they can participate in the plan, assuming the employees are not part of a union or non-resident aliens. But there’s a lot more to consider. There are eligibility rules, exclusions and carve-outs that can be utilized to customize the plan further.

The requirement to cover rank-and-file employees is driven by the coverage of highly compensated employees (HCEs). Typically, a company will offer the retirement plan to all of its HCEs — a population with the largest appetite to maximize retirement savings. If you offer the plan to 100% of eligible HCEs, you must cover 70% of the company’s rank-and-file staff.

When a company gets creative on its coverage rules, they’re likely doing it for one of three reasons:

- To improve discrimination testing to allow those key employees who may be getting refunds to put more money into the plan;

- For operational simplicity to streamline the plan by eliminating hard-to-track employees (e.g., seasonal workers, those who receive tips or employees who are frequently terminated and then rehired); or

- To reduce matching costs overall or to a specific group of employees.

Highly Compensated Employees — In or Out of the Plan?

When it comes to coverage, what are the rules and who must you cover?

Coverage is dictated solely by the percentage of HCEs you cover. An HCE is defined as anyone with greater than 5% ownership in the firm, children, parents, or spouses of these greater than 5% owners, and anyone who earned greater than $130,000 in a prior plan year. (Find the complete definition on HCEs at IRS.gov.)

There are scenarios that exclude HCEs, too. A reasonable example could be a company that runs 150 retail locations with a bottom-heavy workforce. In this example, the company’s coverage strategy is to exclude 100% of HCEs, so coverage is 0%. And since 70% of zero is zero, there are no coverage requirements.

The plan sponsor can define who to include in the plan from its non-HCEs. Typically, participants might be the general manager and assistant managers of each location and the corporate staff.

Excluding hourly workers dramatically simplifies plan operations, and HCEs can be offered a nonqualified plan, which would be a much better fit in this example.

After-Tax (Not Roth) Contributions

After-tax contributions aren’t common in today’s retirement plans, yet they’re worth considering because of their increased savings power.

The first thing that may come to mind when you hear “after-tax” may be a Roth 401(k). These types of plans are appealing — especially if you’re in Texas or Florida or another state with no state income tax. Roth 401(k)s are underutilized, and we encourage more employers to consider them in their plan design.

The after-tax contributions referred to here allow employees, including company executives, to contribute well above the 402(g) limit which is $19,500 in 2021. (If the executive is 50 or older, they can contribute an additional $6,500 in catch-up contributions.) With after-tax contributions, they may contribute up to the $58,000 total plan limit. Participants can roll after-tax money out of the plan and convert it to a Roth IRA. This super-charges their retirement savings beyond what they can do with a traditional 401(k).

It’s important to note that actual contribution percentage (ACP) discrimination testing applies specifically to after-tax contributions. With after-tax contributions, it’s the match that’s the focus. Plan sponsors need to test the match and the after-tax contributions together and compare those same categories to the staff employees.

Allowing for after-tax contributions will require a plan amendment, but it’s a valued feature for company executives and those who want to dabble in the after-tax contribution world. After-tax contributions generally work best in a retirement plan with good participation, a generous match and a subset of HCEs who take advantage of after-tax contributions.

We’re Here to Help

If you’d like to continue the conversation about QACAs, retirement plan coverage requirements, after-tax contributions and the right retirement plan for your workplace, call Definiti at 1-888-912-3653 or email sales@definiti-llc.com.

—

Tom is a Regional Sales Director for Definiti, covering opportunities in Missouri, Kansas, Arkansas, Oklahoma, Louisiana, Texas, and New Mexico. He’s ready to discuss any and all 401(k), Profit-Sharing and Cash Balance plan provisions available under ERISA with clients.

Tom is a Regional Sales Director for Definiti, covering opportunities in Missouri, Kansas, Arkansas, Oklahoma, Louisiana, Texas, and New Mexico. He’s ready to discuss any and all 401(k), Profit-Sharing and Cash Balance plan provisions available under ERISA with clients.

TOM DITZER, C(k)P

Regional Sales Director

—

This material has been prepared for informational purposes only, and is intended to provide general information on matters of interest in the area of qualified retirement plans and is distributed with the understanding that the publisher and distributor are not rendering legal, tax or other professional advice. Readers should not act or rely on any information in this article without first seeking the advice of an independent tax advisor such as an attorney or CPA.