A SIMPLE IRA, also known as a Savings Incentive Match Plan for Employees IRA, is a retirement savings plan employers can offer as a retirement benefit if fewer than 100 employees are eligible for the plan. While a SIMPLE IRA may be a good solution for some companies, it is not without its pitfalls.

SIMPLE IRA plans are designed to be easy to understand and manage for employers and employees. They can be a low-cost and less burdensome retirement plan option for employers — especially from an administrative standpoint — because certain compliance testing and government reporting are not required.

The simplicity of a SIMPLE IRA plan, however, can lead to more complex questions and administrative obstacles. For example, Definiti is often asked to help employers who didn’t realize that SIMPLE plans must adhere to the controlled group rules (i.e., which state that a set of companies with shared ownership are treated as a single company for retirement plan purposes). Another area that can bring complexity to retirement plan administration is a company merger and how SIMPLEs and other existing retirement plans must work together post-merger or after a business sale.

Some drivers and factors make a 401(k) a better choice. As a company grows beyond 100 eligible employees or its need for a more robust retirement plan benefit arise, plan sponsors can choose to sunset their SIMPLE IRA and establish a 401(k).

Any employer, including self-employed individuals, tax-exempt organizations and governmental entities, that had no more than 100 employees with $5,000 or more in compensation during the preceding calendar year (the “100-employee limitation”) can establish a SIMPLE IRA plan. – SIMPLE IRA Plan FAQs (Source: IRS)

Benefits of Switching from a SIMPLE IRA to a 401(k)

Moving to a 401(k) offers numerous advantages to retirement plan sponsors, including:

Increased contribution limits for participants – 401(k) plans allow for higher annual contribution limits than SIMPLE IRAs. For 2024*, the annual employee contribution limit for a 401(k) is $23,000, with an additional catch-up contribution of $7,500 for employees aged 50 or older. (The current limit is $16,000 for a SIMPLE IRA, with catch-up contributions set at $3,500.) This higher limit can be attractive to employees looking to save more for retirement, potentially increasing their overall satisfaction with the retirement plan. (*For plan years before or after 2024, check our Annual Compensation and Contribution Limits for Qualified Plans chart.)

Greater flexibility in plan design – A 401(k) gives employers more options for tailoring the retirement benefit to meet their specific needs through targeted plan design. With a 401(k), an employer can add a profit-sharing component to maximize business owner contributions or a safe harbor provision to bypass certain onerous testing requirements.

More vesting schedule options – 401(k) plans typically offer more options for vesting schedules compared to SIMPLE IRAs. Vesting refers to the process by which employees gain ownership of employer contributions over time. Most profit-sharing contributions within a 401(k) make use of a vesting schedule designed to encourage employee retention.

Participant access to loan provisions – Unlike SIMPLE IRAs, 401(k) plans can include loan provisions allowing employees to borrow against retirement savings. This feature can benefit employees who may need access to their savings. As such, a loan provision can often increase employees’ willingness to participate in the plan.

Plan prestige and attractiveness – Participants may perceive 401(k) plans as more robust and comprehensive benefit when compared to SIMPLE IRAs. By offering a 401(k) plan, employers may enhance their overall benefits package, making it more appealing to company owners/partners and other employees and helping the company attract and retain top talent.

Third-party administration (TPA) support – Another difference with a 401(k) is the option for a plan sponsor to hire a TPA or a 3(16) fiduciary services administrator, like Definiti. This additional support helps reduce the sponsor’s administrative burden and simplifies the complexities of managing a retirement plan, allowing the sponsor more time to focus on core business activities.

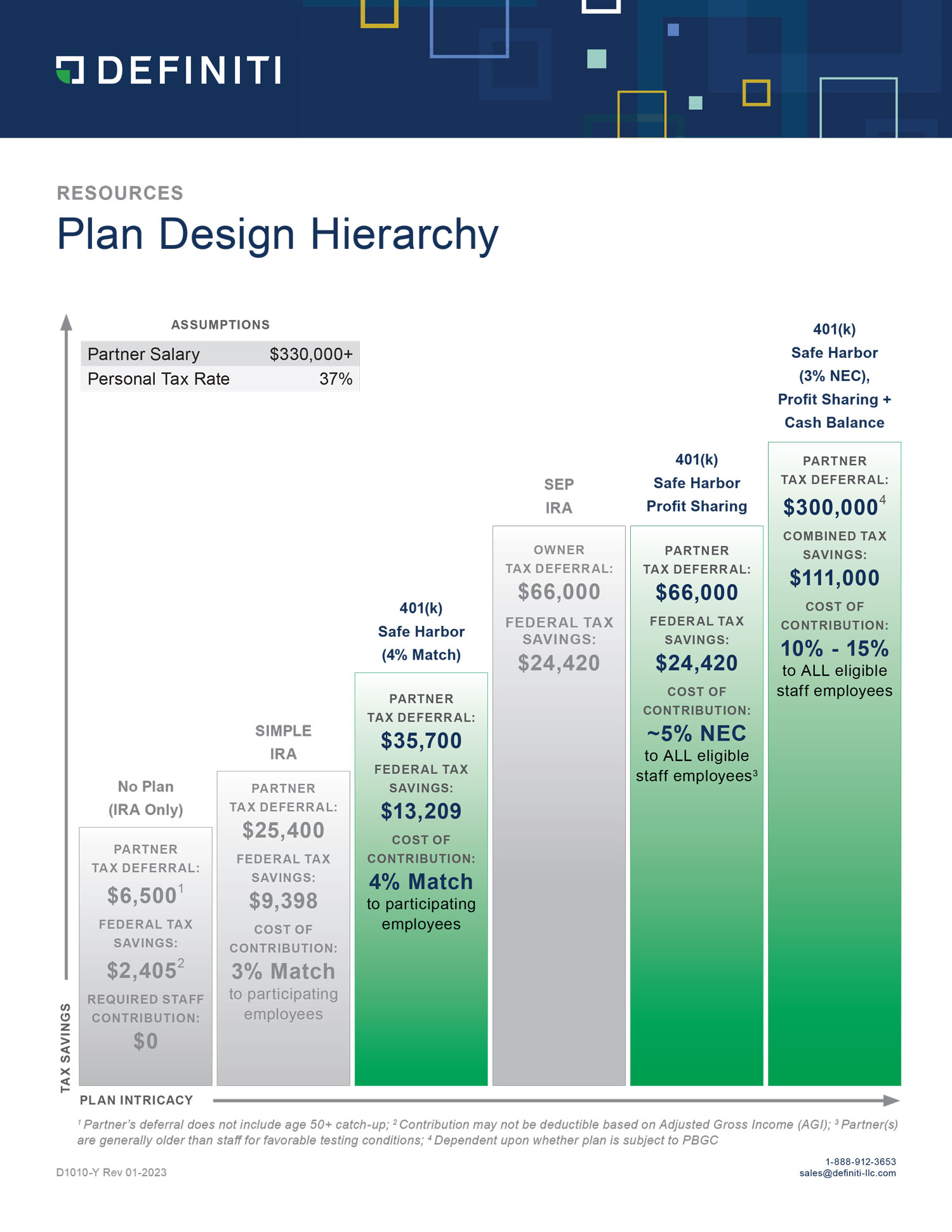

Company owners/partners who want to maximize their retirement contributions can utilize different plan types to maximize tax savings. Download our plan design hierarchy chart to view the different options.a

Signed into law in late 2022, Secure Act 2.0 ushers in a significant number of changes to retirement plans, including 401(k)s and SIMPLE IRA plans. For example, under Secure Act 2.0, effective for plan years beginning after December 31, 2023, an employer may elect to replace a SIMPLE IRA plan with a safe harbor 401(k) plan at any time during the year, provided certain requirements are met. (Previously, employers could not transition from a SIMPLE IRA to a 401(k) plan mid-year.) For more information, including the new law’s SIMPLE IRA-related impact on Roth contributions and other plan features, read At Long Last, SECURE 2.0 Is Here.

We’re Here to Help

Converting from a SIMPLE IRA to a 401(k) involves administrative and regulatory considerations, so it’s wise to consult with your TPA, financial advisor and legal counsel to determine the specific advantages and feasibility of such a conversion. Definiti can partner with you from the initial analysis through making the switch to a new plan. We have deep experience working with retirement plan sponsors and their financial advisors who want to sunset a SIMPLE IRA plan and start a 401(k).

As your business grows, your retirement plan should grow with it. We’re here to help — so let’s start the conversation. Call Definiti at 1-888-912-3653 or email us at sales@definiti.com.

This material has been prepared for informational purposes only, and is not intended to provide legal, tax or investment advice. Any tax-related discussion contained in this material is not intended or written to be used, and cannot be used, for (i) avoiding any tax penalties, or (ii) promoting, marketing, or recommending to any other party any transaction or matter addressed herein. This material does not provide fiduciary recommendations concerning investments or investment management; it is not individualized to the needs of any specific benefit plan or retirement investor, nor is it directed to any recipient in connection with a specific investment or investment management decision. Please consult your independent legal counsel and/or professional tax advisor regarding any legal or tax issues raised in this material.

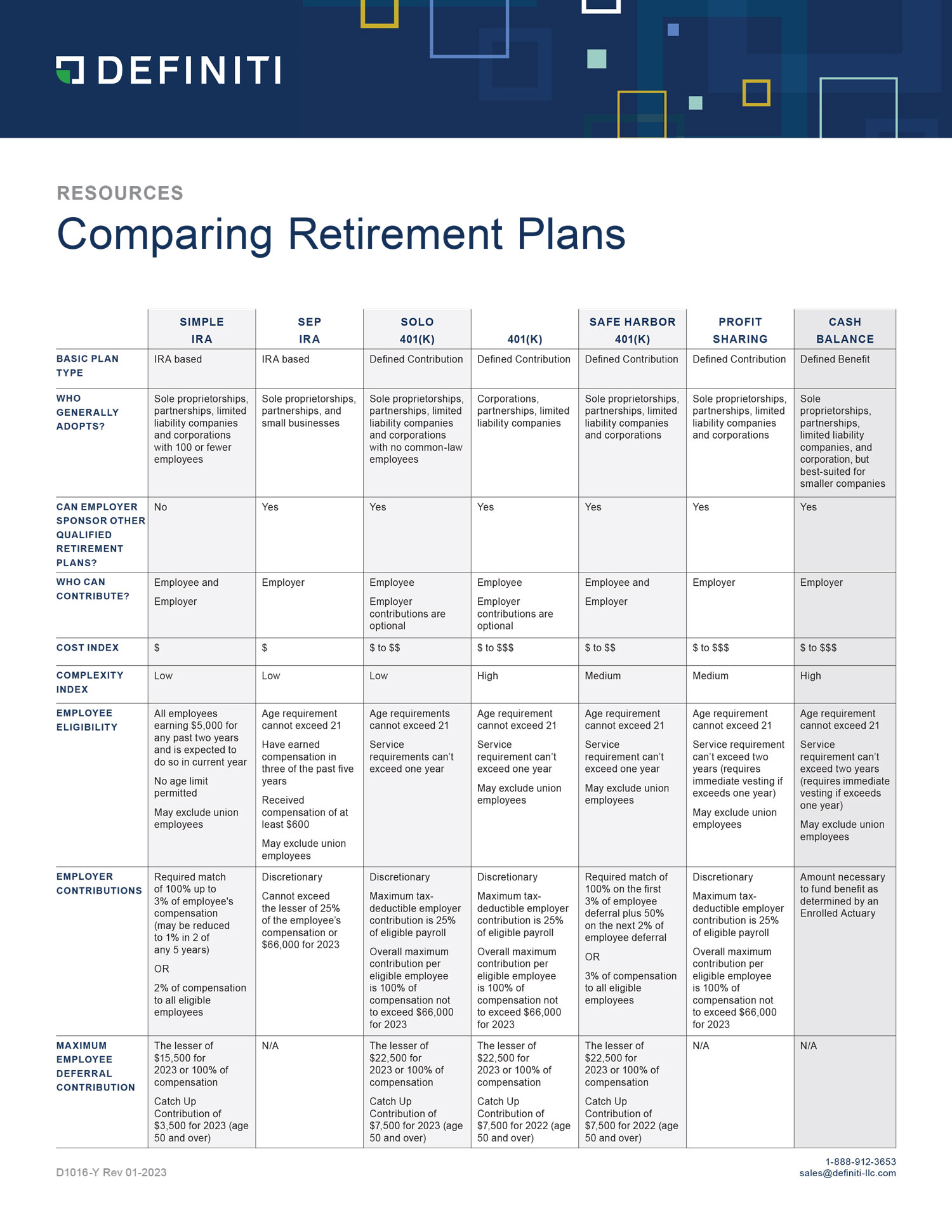

Many types of retirement plans can meet an employer’s needs. Download our plan comparison chart for an overview.