“Cross-testing” is a cutting-edge allocation formula that aligns nicely with a plan sponsor’s goal to help employees have enough money for retirement. The key factors in this allocation are the age of the employees and the idea that the older the employee is, the less time they have to save — so they need more money for retirement. And, conversely, the younger the person, the longer they have for that money to grow.

Before I get into the nitty-gritty of cross-testing, I’ll review the basics. In the U.S., qualified retirement plans are subject to both the Department of Labor’s and the Internal Revenue Service’s nondiscrimination guidelines to maintain their qualified status.

How DC and DB Plans Work

There are two main types of qualified employer retirement plans: defined contribution plans, such as a 401(k) or profit-sharing plan, and defined benefit or pension plans.

The method of calculating contributions for each type of plan is distinct. A defined contribution (DC) plan starts with a contribution amount the plan sponsor wants to deposit for the current plan year. The allocation formula in the legal plan document determines how much of the pie each person would receive today. The benefit upon retirement is whatever has accumulated in the participant’s account, based on how the market does and other factors, including investment choices, rebalancing, etc.

There are numerous ways to allocate employer contributions in a DC plan. One of the most common is pro-rata, where the employer contributes a set amount which is allocated pro-rata based on an employee’s compensation, such as 5%.

A defined benefit (DB) plan starts with the benefit the participant will receive upon retirement (based on current age, etc.) and works backwards to determine how much, in present-value dollars, needs to be contributed to achieve the retirement benefit.

Cross-Testing Defined

The IRS also allows DC plans to use a DB-like method of allocating contributions. The plan must pass a nondiscrimination test — we call it “cross-testing” — that uses this more nuanced and flexible allocation formula.

The contributions for the DC plan are based on the way contributions to a DB plan are made. We’re “crossing over” the two types of plans — DC and DB — to increase the benefit for people who are closer to retirement age.

Cross-testing does not ensure the amount of the benefit will be received upon retirement because it is still a DC plan. What it allows a plan sponsor to do is to determine how much each participant receives of the annual contribution using the DB plan allocation method based on current age, etc. This is why the older participants receive a larger portion of the contribution amount.

How Cross-Testing Works

First, the legal documents that govern your plan must allow for a cross-testing allocation. If you’re not sure if this feature is in your plan document, contact Definiti.

Once your plan document allows for cross-testing, you group participants into classes or segments. You can be quite creative in doing so, as long as you remember that classifying by age, race, religion and gender is not allowed and is discriminatory. Here are a couple of examples:

- A simple, two-group scenario is highly compensated employees (also known as HCEs) in one and nonhighly compensated employees (NHCEs) in the other.

- If you’re a physicians’ office, the physicians could be in one group with the support staff in another.

- For a legal firm, you could classify equity partners in one group and nonequity staff in another.

- You could group employees by job description or title, such as managers in one group and rank-and-file employees in another.

HCE and NCHE Scenario

After employees are classified, the plan sponsor estimates how much to contribute to each group. The contribution target is then cross-tested to determine if the percentages are fair or discriminatory. If discrimination testing fails, percentages have to be adjusted until the results are no longer discriminatory.

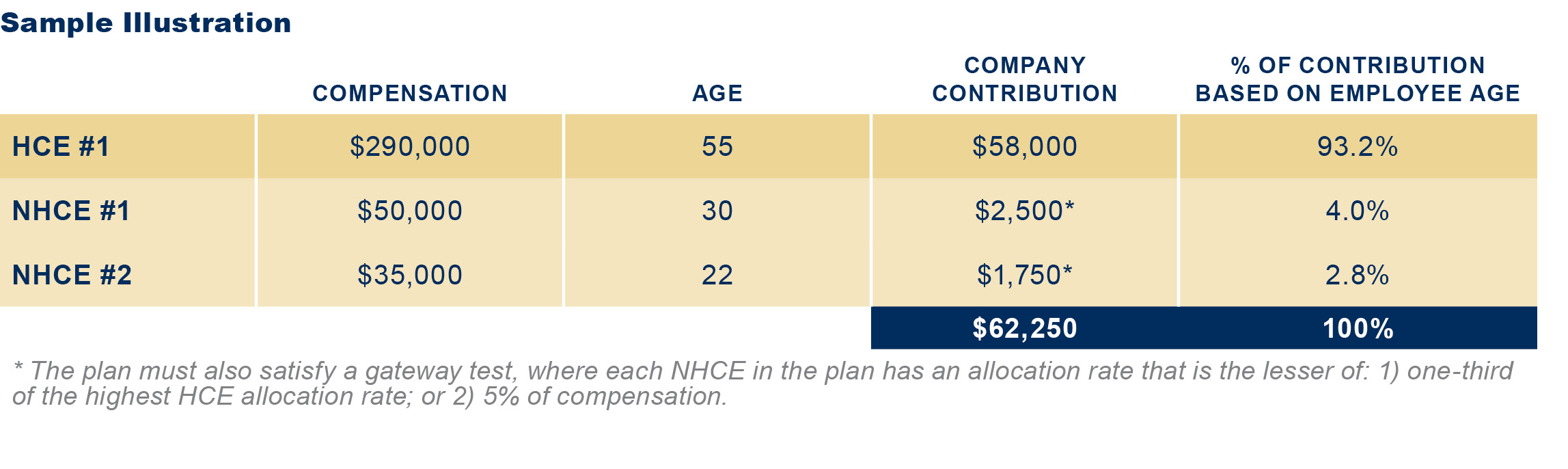

Let’s take a look at a sample illustration to see how cross-testing works. There are three employees in two separate groups — highly compensated employees and non-highly compensated employee (NHCE). Notice the total contribution for all three is $62,250, with the 55-year-old HCE #1 receiving the bulk of the contribution. NHCEs #1 and #2 receive $2,500 and $1,750, respectively.

Of course, this is only an illustration, and your groupings and contribution amounts will work out differently.

Best Fit for Cross-Testing

A cross-tested plan may allow the plan sponsor to allocate a higher contribution rate to older employees, including the owner, while still providing a benefit to the rest of the participants.

Generally, cross-testing works best on plans with fewer than 100 people in them. A quick sort of the census by birthdates can indicate how large the contribution for the older group could be.

Cross-testing works well in all industry types, not just in the medical and legal profit-sharing plan examples I mentioned earlier.

Definiti’s Role in Cross-Testing

To determine if the cross-testing plan design concept is right for your company, we use your plan’s raw census data, transaction information from your recordkeeper and the target contribution amount you’re considering. We run several scenarios designed to meet your plan’s goals, target dollar amount and your employee grouping expectations. We show you how much each person will receive, based on each scenario, and re-calculate the data until we meet your intent.

Timing-wise, moving to this type of contribution formula in late summer or early fall is ideal. It takes time to draw up a new plan document and you must notify your staff in a timely manner to communicate the document changes.

Have I piqued your interest in cross-testing? I hope so. If you’d like to know if your company is a good candidate for cross-testing, contact our Definiti sales team to learn more. If Definiti administers your plan now, your Retirement Plan Consultant is the right person to ask. We’re here to help you make the most of your retirement plan benefits, maximizing plan contributions and more.

We’re Here to Help

If you’d like to continue the conversation about cross-testing, call Definiti at 1-888-912-3653 or email sales@definiti-llc.com.

—

Tonia McBride, QPA, QKC, QKA, ERPA

Tonia McBride, QPA, QKC, QKA, ERPA

Senior Retirement Plan Consultant, Definiti

Tonia McBride is a Senior Retirement Plan Consultant at Definiti. With more than 26 years of industry experience, Tonia assists plan sponsors in the administration of their retirement plan and consults with them and their recordkeepers on a broad range of topics. She helps employers keep their qualified plans in compliance with ERISA and other regulatory mandates, including but not limited to consulting with Definiti’s clients on plan design, compliance testing, government reporting and correcting plan errors. Tonia brings her education and background as an accountant to her work at Definiti, enhancing the services and perspectives she brings to our valued advisor and plan sponsor clients.

—

This material has been prepared for informational purposes only, and is intended to provide general information on matters of interest in the area of qualified retirement plans and is distributed with the understanding that the publisher and distributor are not rendering legal, tax or other professional advice. Readers should not act or rely on any information in this article without first seeking the advice of an independent tax advisor such as an attorney or CPA.