Employers shoulder significant responsibilities when it comes to managing their employee benefit programs. They invest time in researching, evaluating and choosing benefit providers and ongoing program management, involving tasks like enrollment processing, compliance, claims resolution and data management. Employers must also create communication plans, develop content and use various channels to tell employees about their benefits.

The intricacies of health care benefits, for example, evolve in complexity each year, demanding constant vigilance. Life insurance and disability coverage each require meticulous attention to detail and compliance. The company 401(k) presents its challenges, requiring employers to navigate sometimes hard-to-translate Internal Revenue Service and Department of Labor changes while helping to ensure financial security for employees.

PSCA Findings Mirror Definiti Client Feedback

Ask anyone who ever held the responsibilities of retirement plan administration and communication, and they’ll say it’s a big job. Last year, the Plan Sponsor Council of America (PSCA) asked retirement plan sponsors to describe their priorities for 2024 and their anticipated plan pain points, publishing the findings in a question-of-the-week article.

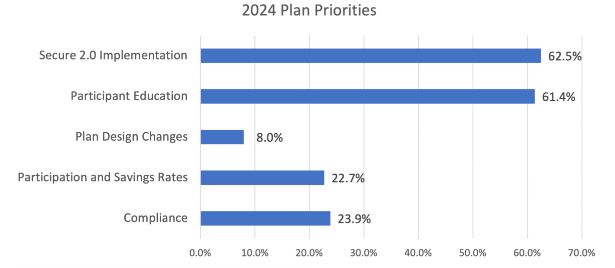

The list of plan sponsors’ concerns was lengthy, but here’s PSCA’s summary:

- A significant majority of plan sponsors, around two-thirds, identified the implementation of SECURE 2.0 provisions as a key focus area.

- Nearly 24% of plan sponsors cited compliance/testing as a top concern, noting the pressures of keeping up with compliance and changing plan rules.

- More than 60% of plan sponsors said their focus includes increasing plan participants’ understanding of plan features and exploring methods to foster participant engagement.

- Approximately one-third of plan sponsor respondents are concerned about compliance issues and strategies that boost participation and deferral rates.

This plan priorities chart is from PSCA and its question of the week article, which featured a list of plan- and participant-related concerns sponsors anticipated for 2024.

SECURE 2.0 and ERISA Education and Compliance

Working with more than 15,000+ plan sponsors nationwide, Definiti hears similar concerns from our plan sponsor clients about the weightiness of plan administration and keeping plan participants informed and engaged with the benefit.

Our clients know they must adapt swiftly to SECURE 2.0 changes, ensuring compliance, effective communication with participants and seamless implementation — but they need guidance and assurance they’re doing things correctly.

Education and compliance are focus areas for Definiti, and our efforts to support plan sponsors date back to when the initial SECURE Act provisions were announced. For the Consolidated Appropriations Act of 2023 (a.k.a. SECURE 2.0), we created a Resource Center available to our clients, financial advisor partners and the public. It includes important deadline dates, educational articles and videos. It’s become one of the most-visited pages on our website.

You likely know that the Employee Retirement Income Security Act of 1974 (ERISA) serves as the bedrock of regulations governing retirement plans, setting standards to safeguard employees’ interests and ensure the integrity of their retirement savings. Since the summer of 2020, Definiti’s legal team has been publishing an ERISA Connection series designed to keep plan sponsors and financial advisors informed about regulatory and compliance matters affecting retirement plan administration.

The additional efforts Definiti does to help our clients, partners and team members stay up to date on regulatory and compliance matters include:

- We have a full-time ERISA attorney on staff.

- To prepare for the SECURE Act specifically,

- We formed an internal committee to review provisions and decide how to best support our clients.

- We hosted internal meetings to share timely information with our client-facing team members.

- We regularly feature regulatory and compliance topics during our recurring Definiti Academy educational webinar series.

“Care and Feeding” of Your Retirement Plan Document

With at least a quarter of plan sponsors seriously concerned about compliance and testing, ensuring the plan document is updated is critical. While this may seem fundamental, it’s essential. In fact, two of the common mistakes Definiti sees its plan sponsors make are failing to keep their plan document updated and not complying with its operational terms. Retirement regulations like SECURE 2.0 also mandate prompt updates to the plan document.

The IRS strongly recommends you review your plan document annually to ensure adherence to its terms. Failure to amend the plan document following internal changes or missing IRS-mandated deadlines may necessitate corrective action.

Given that many plan sponsors delegate plan-related responsibilities to multiple employees and retirement service providers, it’s crucial for anyone assisting with these benefits to understand the plan document thoroughly and to stay informed about changes made to it.

3(16) Fiduciary Services: A Remedy for Sponsor “Pain”

If you’re a plan sponsor at a smaller company, you could likely have a second job as the business owner or department manager. Or you may be part of a small team overseeing employee benefits, but you barely have enough hours in the day to give each benefit the time it deserves. No matter how you’re connected to the company retirement plan, you could need more help.

Many Definiti clients add a 3(16) Plan Administrator because of the never-ending administrative tasks. A 3(16) Plan Administrator can take over critical administrative duties and as a co-fiduciary on the plan.

With our help, you can stop spending time on loan and distribution approvals, sending required participant notices, signing and filing the annual Form 5500, uploading payroll contributions to the recordkeeper on time and more. (Download this 3(16) fiduciary services resource to learn more.)

Definiti’s financial advisor partners have recommended a 3(16) plan administrator to their clients, including those with start-up retirement plans. To learn more about how 3(16) services reduce the administrative burden, read about two plan sponsors who work with us.

Support of a Trusted Advisor

Your retirement plan’s financial advisors bring a wealth of knowledge to the table. They understand the nuances of retirement planning, providing strategic guidance and investment expertise. These experts help you choose investment options that align with your plan’s goals and risk tolerance, ensuring optimal outcomes for your employees’ savings.

Your financial advisor’s role extends beyond investment decisions, of course. They actively educate your employees about the importance of retirement savings, asset allocation and long-term planning. Financial advisors’ personalized guidance empowers participants to make informed choices, ultimately contributing to their financial security.

We’re Here to Help

Remember that Definiti, your financial advisor and other plan providers, like your recordkeeper and payroll provider, work collaboratively to streamline retirement plan activities. Together, we form a cohesive team dedicated to supporting you and ensuring a successful retirement journey for your employees. Our collective expertise extends beyond administration and advice; we serve as your strategic partners, helping you simplify the administration of your company’s retirement benefit program and helping you meet the needs of your plan participants.

To learn more about information in this article:

- If you’re a Definiti client, contact your Retirement Plan Consultant (RPC).

- If you don’t partner with Definiti, let’s start the conversation. Call 1-888-912-3653 or email salessupport@definiti.com.

- If you’re interested in finding a new financial advisor or platform partner or require details about adding a 3(16) plan administrator, contact your RPC or call 1-888-912-3653 or email us.