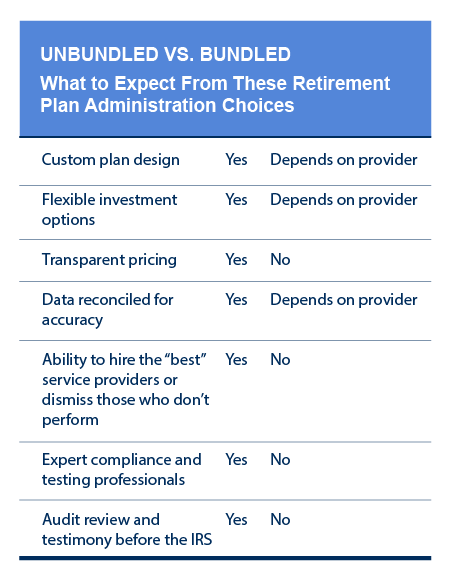

Plan sponsors considering the best option for outsourcing their retirement plan administration have two options to choose from — bundled and unbundled.

Bundled plan administration involves working with a single entity that typically manages all aspects of the retirement plan on the plan sponsor’s behalf. Unbundled plan administration is a more diversified outsourcing model. Plan sponsors work with several independent service providers to manage different aspects of the plan, including a recordkeeper, third-party administrator, investment advisor and 3(16) fiduciary administrator.

While bundled administration may be less expensive, unbundled administration offers far greater customization of the plan design, allows the plan sponsor to choose the best service-provider mix, and brings more overall control to the plan administration process

Highlights of Bundled Plan Administration

Bundled plan administration reduces the number of decisions a plan sponsor must make because retirement plan management is performed by a single entity, such as a recordkeeper. The selected company then manages almost every aspect of a retirement plan on behalf of the employer, including plan design, compliance, participant education and recordkeeping. In some cases, the bundled provider is also responsible for choosing the investment lineup and monitoring the ongoing appropriateness of those options.

This fully outsourced model of plan administration can be an effective way for employers to manage their retirement plans while reducing the complexity of administration.

The bundled retirement plan administration model can be less expensive than unbundled, but customization is limited. This “one-stop shop” is for retirement plan sponsors willing to sacrifice plan design flexibility and complexity when working with just one provider.

The Internal Revenue Service (IRS) allows for the outsourcing of retirement plan administration, which can make the process much more manageable for retirement plan sponsors. Outsourcing plan administration falls under two categories — bundled and unbundled.

Highlights of Unbundled Plan Administration

Unbundled plan administration is a more diversified outsourcing model where a retirement plan sponsor contracts with several individual service providers to manage different aspects of the plan.

In this scenario, a retirement plan sponsor will work directly with specialized independent service providers to administer the plan and manage investments. The unbundled model offers far greater customization of the plan, including the administration process and more overall control, as the plan sponsor can find the best fit for the various needs of the plan.

The unbundled service providers deliver on their individual responsibilities yet work together seamlessly to provide the desired plan outcomes.

The unbundled retirement plan administration model offers a “best of the best” approach with more flexibility, complete customization and overall plan control. Unbundled services give the plan sponsor the best access to design, compliance and investment experts who help manage the unique aspects of the retirement plan.

When determining the best administration model for your retirement plan, consider:

• Plan design complexities

• Administrative work you find burdensome (for example, government form filing)

• Outside expertise you’d find beneficial

• Size of your internal team responsible for the retirement plan benefit

• Plan administration costs

Which is Best — Bundled or Unbundled Plan Administration

So, how do you decide whether a bundled or unbundled model is the best option for your company’s retirement plan?

Here are a few things to consider when you make your decision:

Complexity of your retirement plan’s design – If you need help deciphering complex plan provisions (ERISA related and other regulatory changes, for example) or want to customize your plan’s design, unbundled services are the better option, as you’ll have access to experts.

IRS- and Department of Labor-related tasks – If you need assistance filing specific IRS and other required forms with the government, the services offered in an unbundled scenario, especially if a 3(16) fiduciary is part of the provider mix, could be beneficial.

In-house retirement plan expertise and availability – Many of Definiti’s clients who go with the unbundled service model do so because they have limited retirement plan expertise internally, their HR staff is small, or a company owner doesn’t have time to manage the employee benefit effectively. Going with an unbundled model makes sense if this is the reality at your organization.

External administration support team size – The “one-stop-shop” bundled model simplifies the number of providers a plan sponsor works with. This streamlining includes fewer choices related to plan design and provider “fit,” — but a bundled approach adequately services many plans.

Internal HR Resources – Unbundled providers generally provide a dedicated contact to answer your questions related to your plan. If your HR department doesn’t have dedicated payroll and benefits personnel, you may benefit by supplementing your staff using the unbundled approach.

Plan administration cost – If cost is a significant factor in determining which model to use, choosing a bundled provider could be the right decision as it is generally less expensive — but keep in mind there are tradeoffs.

No matter if you choose to use the bundled or unbundled model, your responsibilities as the retirement plan’s fiduciary are similar. Being a fiduciary for your retirement plan means you are legally and ethically responsible for managing the plan in the best interest of plan participants and their beneficiaries. As a fiduciary, you must act with prudence and care to ensure the retirement plan is effectively managed and the investments are diversified and appropriate for plan participants’ retirement goals. You must follow the plan document and relevant laws, disclose conflicts of interest and avoid engaging in transactions that would benefit you at the expense of the participants.

We’re Here to Help

Definiti offers both plan administration bundled and unbundled plans to retirement plan clients. We provide third-party administrative services for all qualified retirement plan types, including 401(k)s, 403(b)s, 457s, profit-sharing plans and traditional pension and cash balance plans. Our relationships with more than a dozen retirement plan platforms enable us to pair our services with leading industry providers and find the best fit for each plan.

Are you interested in learning if bundled or unbundled is best for you and your plan? Let’s start the conversation. Call Definiti at 1-888-912-3653 or salessupport@definiti.com.